Project Evaluation:

- New Stream support projects at both the pre-commissioning and post-commissioning stage.

- Pre-commissioning we can assess viability and financial feasibility of a site through bespoke modelling and analysis. We can then produce reports tailored to support any stage of due-diligence work or the funding process.

- For existing sites we can make an assessment of options to enhance value either through increased revenue / income streams or through energy reduction or improved procurement strategies.

Analytical Capability:

New Stream’s sophisticated models capture the complexity of the real underlying energy markets.

We are recognised as independent, transparent and rigorous with our assumptions and methodology.

- Market revenue modelling for new projects, covering all major generation types

- Low-carbon: Hydro, solar, wind

- Integration technologies: DSR, Gas Peakers, Diesel & Storage

- Private Wire opportunities

- Multi-technology generation projects

- Run hours and fuel requirements planning forecasts to support infrastructure planning and connection applications for gas / diesel assets

- Scenario analysis on different go-to-market strategies, informed by your risk appetite and / or project funding requirements

- Project feasibility models to support project development and funding applications

Bespoke Analysis – recent mandates

- Large solar project evaluation

- Hybrid solar and gas project using shared connection

- 20MW Battery storage feasibility and due-diligence

- DFR project due-diligence, technical review and income report

- Grass roots hydro project feasibility

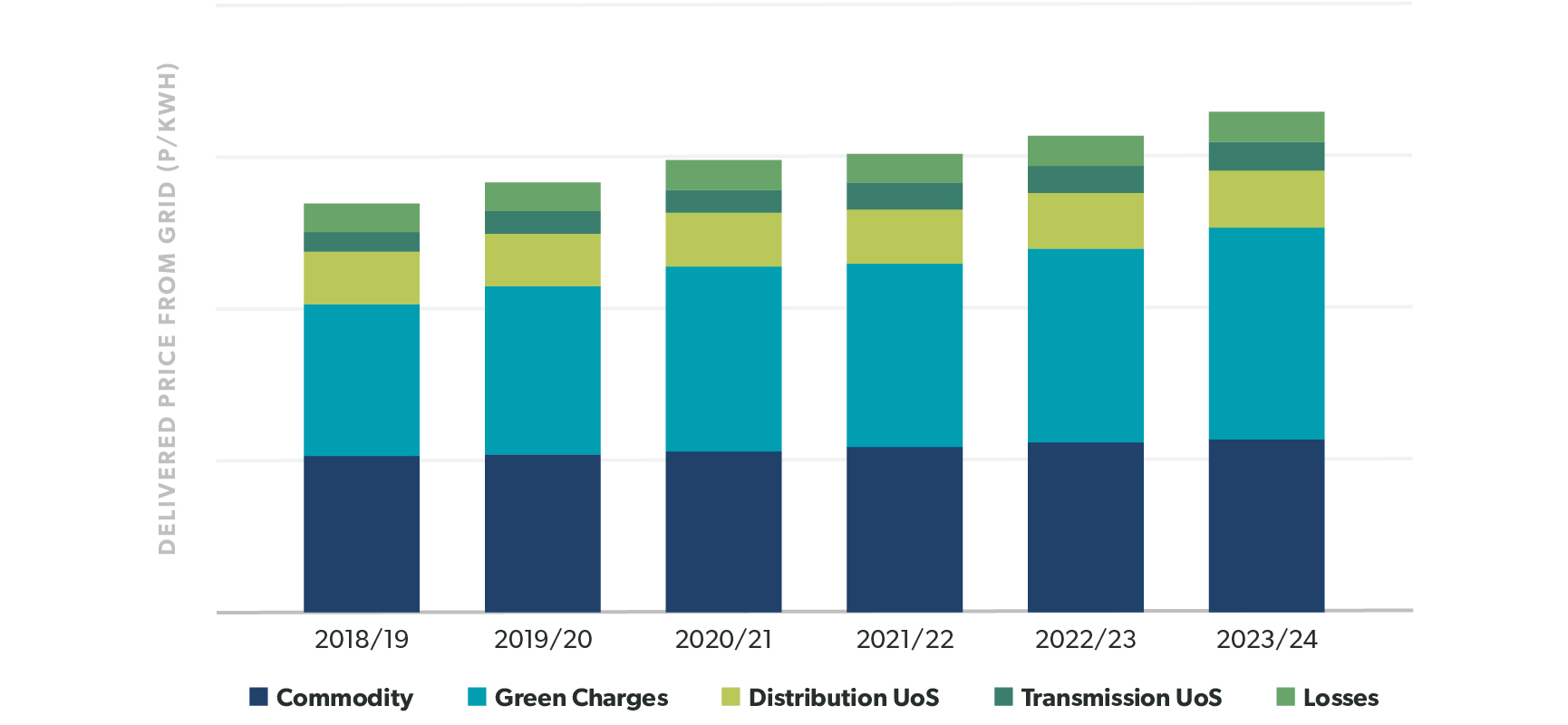

Let us provide you with a tailored forecast of your future electricity costs

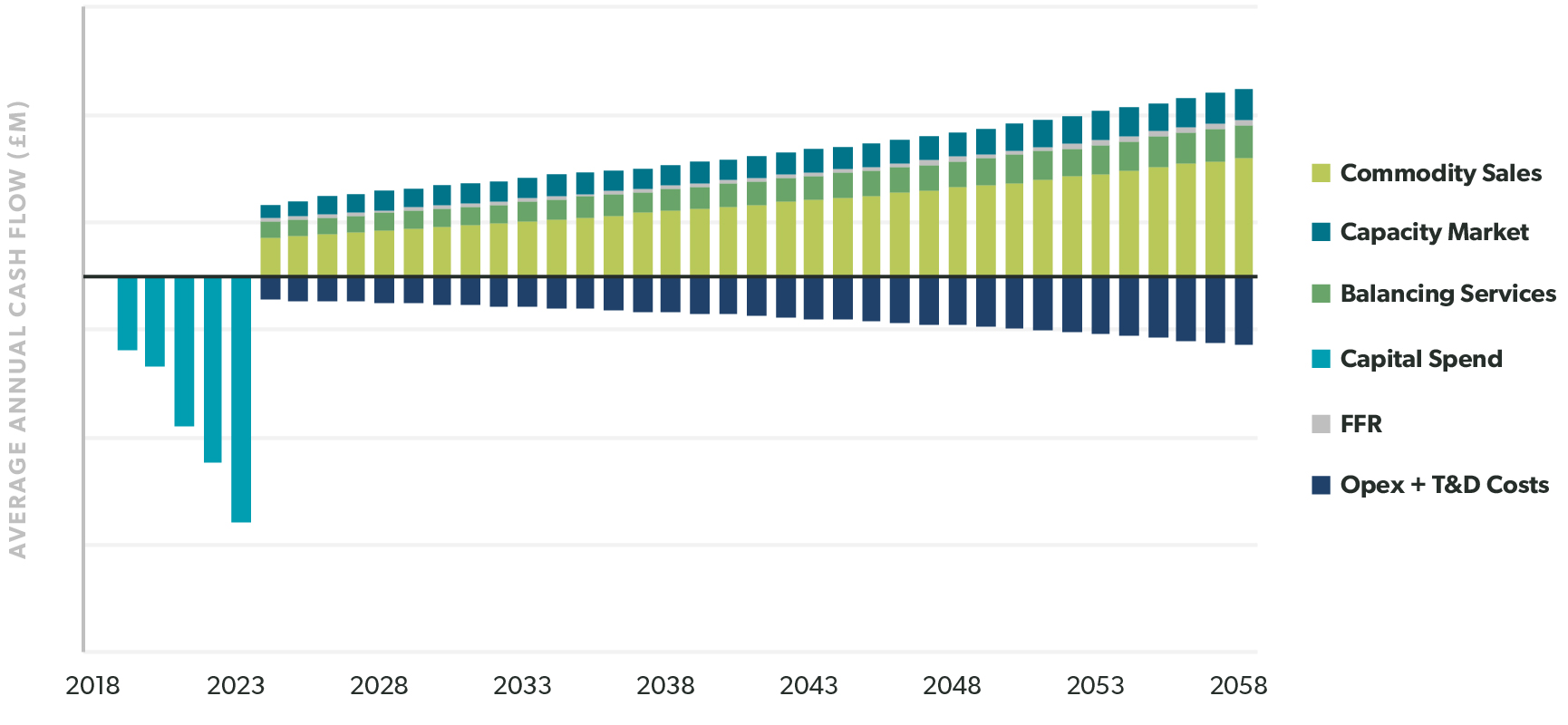

Let us model the stacked revenues available for your generation projects

PPA and Energy Off-take Management

- Submit metered import and export data to qualify for issuance of ROCs / FiTs and REGOs.

- Administration of the receipt and transfer of ROCs /FiTs and REGOs in accordance with the PPA.

- Reconciliation and reporting of Power payments.

- Reconciliation and reporting of RO / FiT payments.

- Reconciliation and reporting of monthly export HH data and Off-Takers payment.

- Ensure off-taker passes through embedded benefits at the agreed rate on a monthly basis.

- Update the Company on any changes in law that would have implications for your PPA.

- Work with the Company to forecast export volumes (on a monthly basis) to enable management of imbalance risk.

- Provide this forecast to the off-taker in required format.

- Give an overview of the current power market pricing and conditions.

- Provide the company with the reference index price.

- If required work with the Company to time and execute the fixing of the power price in the pricing window.

- Report on price fixed achieved.

Credit Control

- Power / commodity Invoices.

- Embedded Benefit Payments.

- ROC / Ofgem payments.

Performance and O&M Management:

- Daily plant performance management and monitoring.

- Performance trend reporting.

- Report on plant solar performance in P&L format.

- Monitoring of O&M response time to any outage.

- Event / Incident history log and reporting.

- Deliverable : Weekly report to the asset owner on the above.

- Identify issues and areas where performance / P&L can be improved.

Financial / Company Secretarial Services

All financial and company secretarial services will be carried out by our qualified ACMA accountant with significant experience in operating special purpose companies.

Approach to service delivery:

Processes and Controls

Every process will have a clear and detailed operational check list so that it is always clear what needs to be delivered and these processes will be capable of review as required.

Financial controls are always vital and these will be presented to the board for approval at the earliest opportunity. If required these will include setting up banking arrangements, insurances, authorisations and mandates and ensuring all relevant company secretarial registrations are made.

The provision and approval of an annual compliance calendar will also ensure that the board are kept aware regularly of project progress and this can include annual reviews with the external auditors.

Book keeping Function

In understanding the contractual structure, the financial reporting role will clearly and concisely report on key issues.

- Clear communication and reporting with lenders and shareholders identifying relevant key performance indicators and reporting against financial model estimates.

- Ensuring accurate billing from suppliers in line with contracts and that any income or VAT repayments are received as soon as possible.

- Ensuring information is captured at source within the financial chart of accounts to integrate all financial reporting, future modelling requirements, tax reporting and the company secretarial records.

- Providing contractual and statutory compliance timetables to ensure objectives are being met.

Statutory Audit process

Ensuring an efficient statutory audit process is vital to give confidence to lenders and shareholders. Our team have experience of managing the audit process for over 120 legal entities each year which included preparing draft accounts and liaising with auditor’s compliance testing onto detailed clearance negotiations with audit partners through to delivery of signed accounts to Companies House and stakeholders. We are fully aware of the issues likely to cause concerns to the technical department of audit firms, the discussions required to resolve these issues with audit partners and how to get value from the audit partner’s experience.

Financial Modelling

We have extensive experience in building and operating financial models from those used at financial close to determine fees and funding requirements, through to operational models built to ensure compliance with lender contractual obligations and to deliver shareholder value.

Knowing how to update models and being able to extract the relevant commercial information required by the shareholders or lenders and being able to identify the drivers of changes in the modelled outputs is key to the successful budgeting and forecasting process.