“We have seen European gas markets bounce off recent lows over the last week. LNG supply and the amount of floating storage are tightening things up, but we are still down 65% since the start of the year.

Jamie Banks

PPA Manager at New Stream

“Ukraine tensions, seasonal works in Norway and heat waves in parts of Europe disrupting energy networks are also having a short-term impact on pricing, particularly at the front end of the curve.

Based on the data and market fundamentals we are currently seeing, we do not think this is the start of a strong bull rally in pricing.

Still, we are hopeful that the market for renewable generators can consolidate around these levels.

We should remember that European gas storage levels are almost 90% full.

This will lower any immediate need for additional supplies amid higher flows from the Norwegian sector over recent days and persistently sluggish industrial demand, which we discuss further in this New Stream client briefing. ”

Charles Ward

Head of Renewables at New Stream

“We are still focusing on downside price risk protection and PPA hedging strategy for our clients further along the price curve. Looking at where we are right now, we need an icy start to Q4 to spike things higher.”

Francesca Reay

Energy Market Analyst at New Stream

Key Drivers and Energy Market Fundamental

- LNG Pricing is now essential for UK Power and PPAs.

- Liquefied natural gas stored on ships has jumped to the highest levels in over two months.

- Weak demand and high storage inventories in Europe push LNG toward Asian markets.

- Heat waves in parts of Europe disrupt energy networks and increase cooling demand (see separate commentary).

- Ukraine tensions and seasonal maintenance works in Norway also support gas pricing.

- PPA pricing moves higher relative to NBP gas moves and UK Baseload Power.

- Price volatility increases in line with underlying commodity levels

LNG Carrier Investment – More LNG to come…

- Spending on new LNG carriers since the beginning of 2022 represents 30% of total new building investment.

- This is more than any other sector, including container ships.

- This is despite significantly higher new ship prices, up from $210m for a standard 174,000 m3 vessel at the start of 2022 to $265m today.

- The global order book now stands at 330 new vessels.

- New LNG contracts were placed this year with 30 carriers valued at $8 billion

Cooling Demand

- This week, temperatures reached as high as 47C in Italy and wildfires rage in Greece.

- The Cerberus heatwave, named after the mythological three-headed dog guarding the gates of Hell, has triggered wildfires across southern Europe.

- Cooling demand is up dramatically on the back of this.

- The higher record temperatures worldwide are putting additional strain on grids.

- Increasing the likelihood of forced power cuts.

- As temperatures continue to rise, the reliance on air conditioning escalates further.

- Power demand in Texas hit a record high as homes and businesses cranked up air conditioners to escape the heat wave.

- Power consumption in Texas rose to a staggering all-time high of 83GW on Tuesday afternoon

Industrial Power Demand Weak

- Power demand in Europe looks set to drop to the lowest level in more than twenty years as industrial production cuts appear increasingly permanent.

- Electricity demand in the European Union is set to drop by over 3% this year to levels last seen in 2002.

- Heavy industry shut down across the continent due to high energy prices.

- According to the International Energy Agency report released last week, power demand was significantly lower in the first half of 2023.

More European Renewable Capacity Coming

- The EU’s climate and energy security goals require it to build over 30GW of new wind farms annually by 2030.

- EDPR to invest 20 billion Euro by 2026 in renewable generation capacity.

- RWE will complete and commission over 30 new wind facilities this year.

- SSE’s Dogger Bank will be the largest offshore wind farm in the world at 3.6 GW.

- Equinor and SSE are to file a planning report for a potential 1.4GW fourth phase of the Dogger Bank.

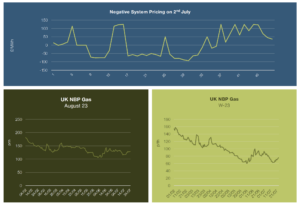

Negative Power Pricing Across European Energy Markets

- Electricity prices across Europe fell below zero again for prolonged periods at the start of the month.

- Strong wind performance combined with the peak season for solar generation forces generators to pay for the power they export to the grid.

Commentary

Charles Ward

Head of Renewables“These negative prices could be a preview of what’s to come for European power markets if the planned renewable capacity is built out.

If it is, then we will need a shift in demand. I suppose the hope is that eventually, larger electric car fleets, smarter grids and better battery technology will catch up.

However, for now, a mismatch creates huge issues for policymakers, renewable generators and energy suppliers.”.

Short-Term Supply and Demand Outlook

- LNG imports continue, but some cargo is lost to Asian markets.

- Gas pricing is off the lows of May but is still significantly down.

- PPA and Green Gas pricing are lower on the back of this.

- Norwegian pipeline flows remain relatively strong as we move through “maintenance season”.

- Europe gas storage levels are high.

- For now, the market is pricing in a much better outlook for power and gas market fundamentals.

NSR Winter 2023 PPA Price Outlook

- The demand outlook remains weak on the industrial and commercial side.

- The market needs an icy start to the “Heating Season”.

- On the power side, windy conditions are forecast to persist into Q3.

- Gas prices are off the lows but have dropped to 2021.

- Ahead of winter, French nuclear plant outages could create some upside price risk if summer is warm.

- Monitoring LNG market activity as we move through summer will be essential.