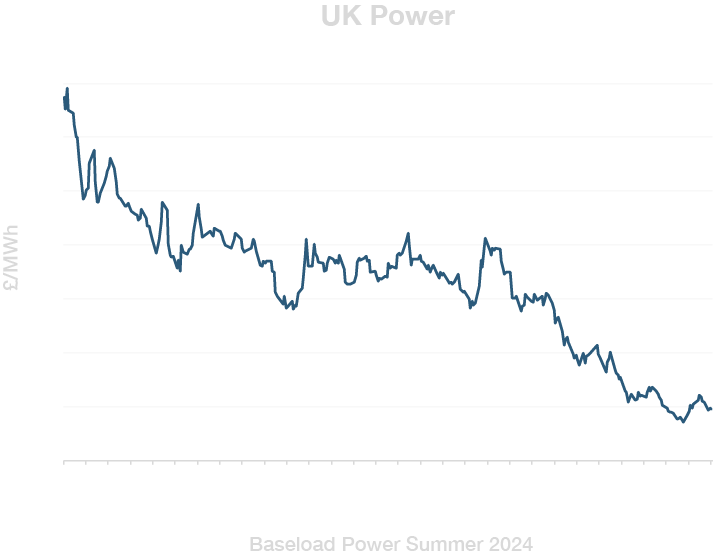

PPA and Green Gas Markets Stabilise

Current Market Fundamentals

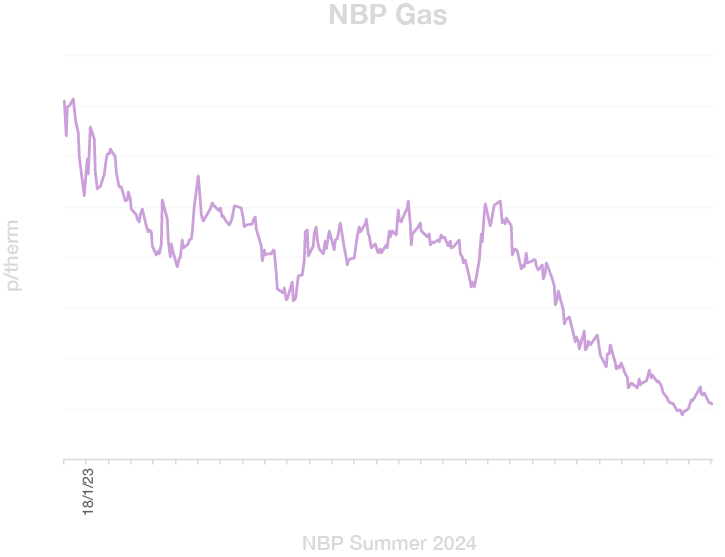

- NBP gas is still the key driver of UK power and PPA pricing.

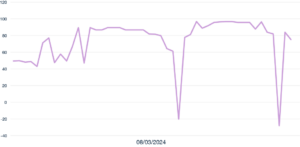

- Renewable (wind) performance is key to setting “spot” and “system pricing”.

- We exit winter with a weak demand outlook.

- Gas storage at circa 60% levels must be filled, adding some price support.

- Continued strong renewables performance.

- Some LNG cargo diversions are likely as we move into summer.

- Good pipeline supply on the gas side.

- Despite issues at Nyhamma, Norwegian gas exports and strong send-out from LNG terminals are still in place.

- Expected continued ramp-up in French nuclear generation availability.

Commentary

Charlie Ward, Head of Renewables at New Stream

“We seem to have found some price support in the short term, but unfortunately, the medium-term market fundamentals remain weak.”

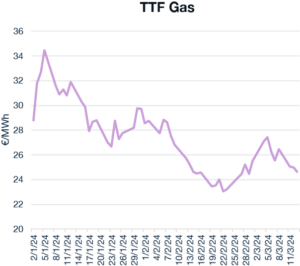

Will we now see a rebound in green gas prices?

- Natural gas prices at the NBP and Dutch TTF markets finally found some support.

- Headline-driven moves on the back of relative global gas values for LNG.

- As we move through summer, LNG diversions away from UK import terminals are likely.

- Market calmness after geopolitical volatility spooked spot markets.

- Traders are now focusing on managing supply shortages this coming winter.

- Pricing will need to be high enough in Europe to attract the same volume of LNG as Natural gas inventories are now about 60% full.

- European gas demand in the third quarter of 2023 was 20% below the 2019-2021 average.

- The end of Q1 weather could alter the gas price trajectory.

Fran Reay

Market Analyst at New Stream“We have seen NBP and TTF gas prices stabilise as we have moved through March. LNG pricing seems to have been the main driver, with headlines surrounding the possible Asian cargo buying.

Regarding actual data, we have started to see some cargo diversions planned for the next month, and we will continue to monitor that. We have also clearly seen some speculative short covering of gas positions and added some price support.

Where we go from here is still far less obvious than the move down over the last 18 months or so. Demand is still very weak, and we still have well-above-average inventories.”

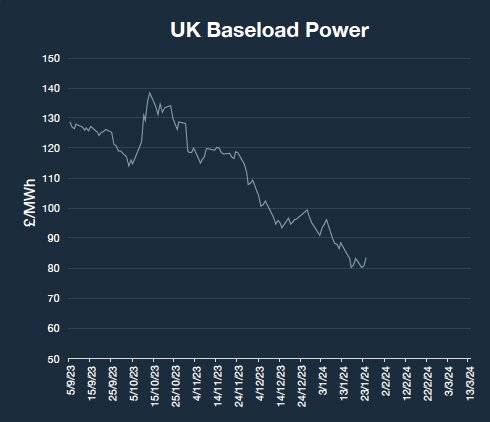

UK System Power Pricing Remains Weak

Relative Value In 2025/26 For PPA Generators and Green Gas Producers.

- Supply and demand fundamentals continue to depress short-term markets.

- Forward markets still hold some risk premium above the spot.

- Opportunities for PPA and Green Gas fixing further out along the price curve.

- 2025 and 2026 are now well above spot markets

Commentary

Charles Ward

Head of Renewables

“For clients looking for budget certainty and downside price protection, we still advocate looking at forward PPA fixes. We appreciate that some will want to take the price risk, but for others, a fixing strategy will better suit their business approach and financing constraints.”

Is this the bottom of the PPA market?

Jamie Banks

PPA Manager at New Stream“The move down has been easy for most generator clients to manage. Early forward price fixing of PPAs has locked in value for 2024 and well into 2025.

With such a solid downward price trend in place, we are always reluctant to call the bottom of the market, and medium-term supply and demand fundamentals remain weak.

However, we have started to see some price support and a degree of stability at the front end of the UK gas and power curve. As we move out of winter, we seek further pricing consolidation.

The summer injection period will now be critical, as storage sites need to be filled for the following winter, and lingering geopolitical and LNG supply risks are a backdrop.”

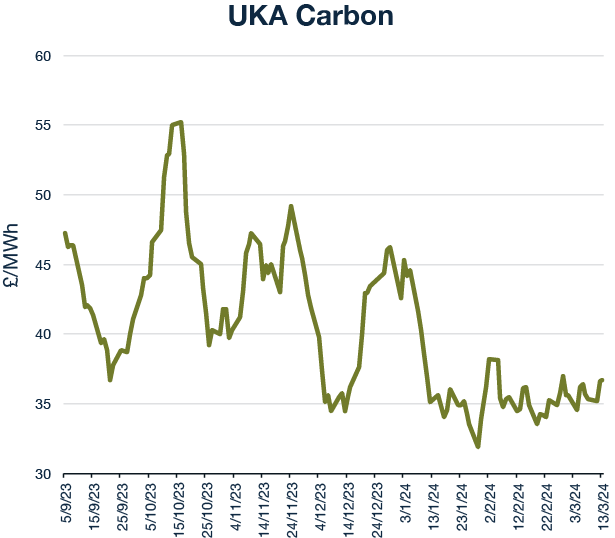

China’s Carbon Certificate Market Soars to Record Levels.

- Emissions allowances rising before the introduction of new rules.

- Prices are up firmly in 2024 but remain lower than in EUA and UKA market pricing.

- Spot prices rose to 83 yuan or around $12.

- Chinese companies are preparing for the introduction of China’s new carbon emissions regulations in May.

Any new gas-fired power stations in the UK ‘must be net-zero-ready

- CCGT power plants must be ready to connect to carbon capture technology or be able to burn hydrogen instead of gas.

- The government aims to capture between 20 and 30 million tonnes of carbon emissions annually by 2030.

- Global economies are returning to gas as a transition fuel, and new deals for LNG supply extend beyond 2050.

- The COP28 climate talks last year ended with the inclusion of a line about transition fuels.

Strategic Energy Reserve for Power Network

- House of Lords report calls for urgent action on storage.

- The UK must act quickly to build a strategic long-duration energy reserve.

- The UK doesn’t have strategic storage for natural gas.

- Centrica Plc shut its gas storage site (the UK’s most prominent facility) in 2017.

- Rough was partially re-opened in 2022.

Methane Emissions Near Record Despite Pledge

- Methane emissions from fossil fuels held near a record high last year.

- This was outlined in this week’s International Energy Agency “Methane Tracker report”.

- According to the IEA, the fossil fuel industry must cut methane emissions by 75% by 2030.

If you want to receive our weekly Whatsapp PPA / GPA price broadcast. Get in touch with Fran or Jamie.