“We are seeing colder than normal weather settling into Europe over the next week which should be supportive for gas and power prices”

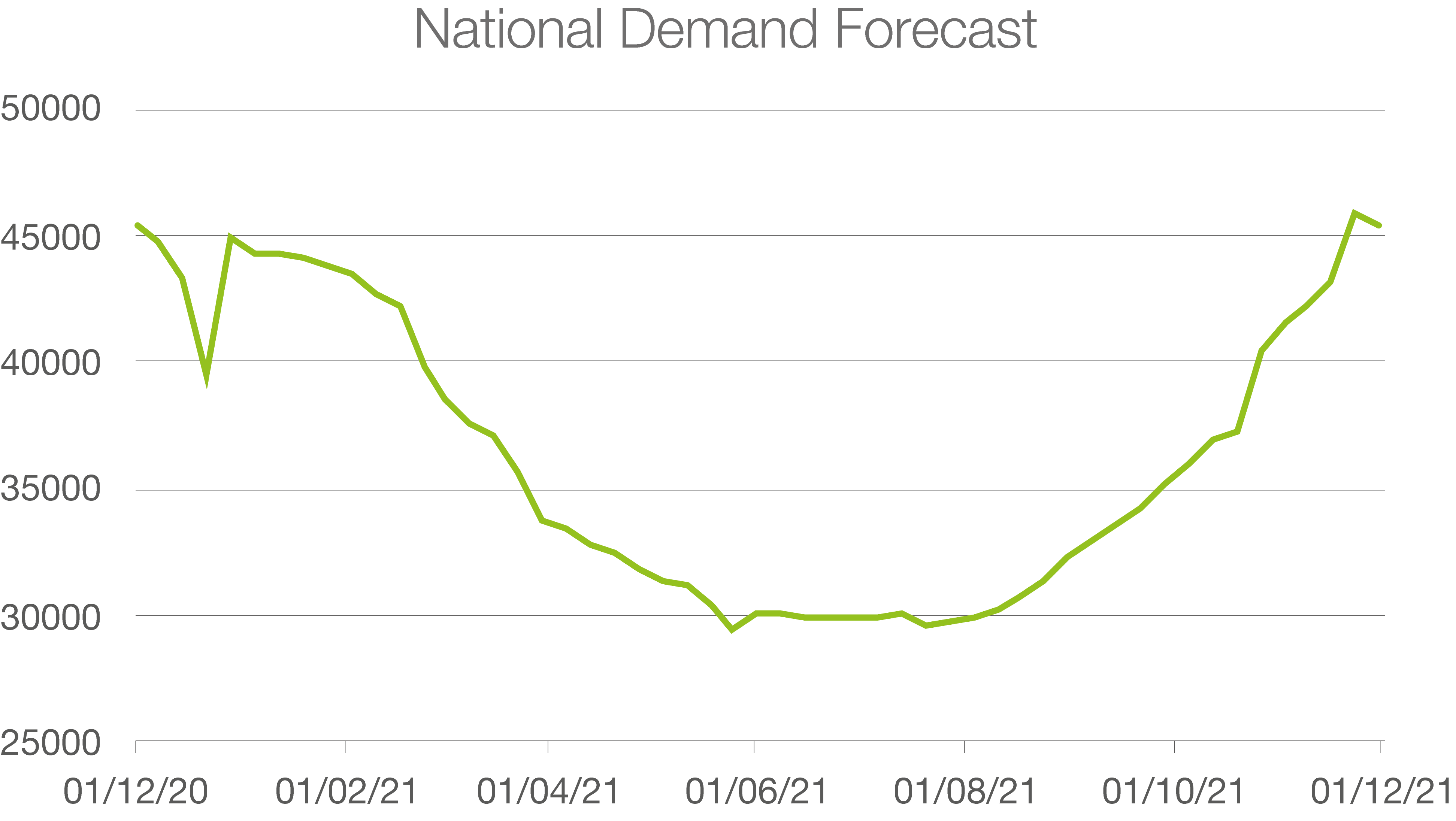

“Obviously we had the really warm winter in 2019, but if you look at the forecast weather models now, we are looking at temps more likely around the 25 year average. I am sure people are fed up with a Covid angle on everything, but it will be interesting to see if power and gas demand will rise more quickly in cold weather than in previous years, with those stuck working at home turning up central heating that would otherwise have been switched off if they were in the office.”

Adam Green,

Operations Manager at New Stream.

|

|

If temperatures remain below normal for December then more LNG is going to be required. If temperatures remain below normal for December then more LNG is going to be required. |

|

|

Home heating demand and a more normal winter will draw down on gas storage inventories. |

The UK may also have to compete with Asian LNG buying interest where prices are also up on cold. |

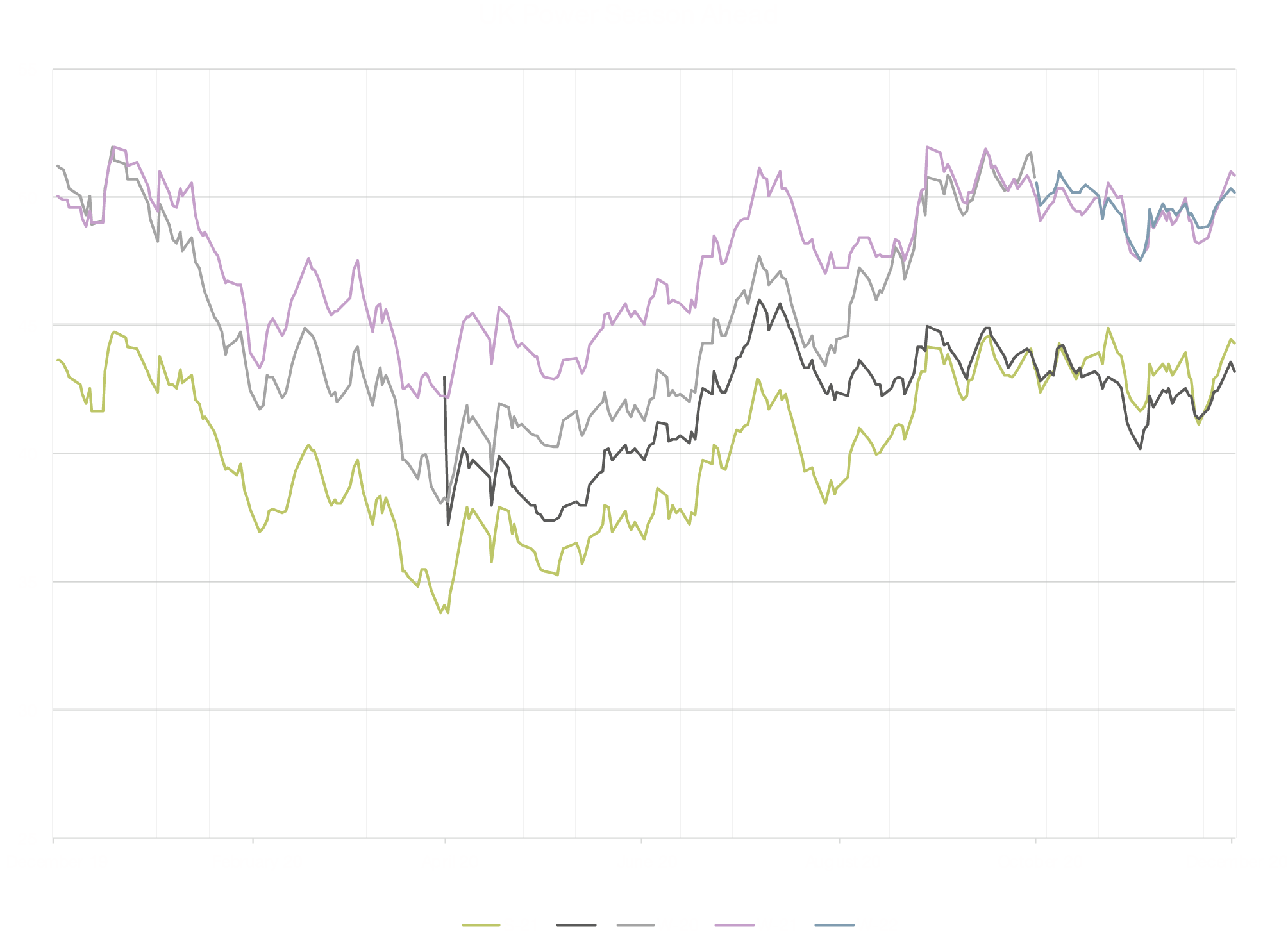

“Most of the impact of increased heating demand is going to be seen in at the NBP (UK gas market). We have been monitoring the market closely for our green gas generators and have been flagging strength as a opportunity for short term price fixes. This seems to have worked well for them. NBP prices are almost 5% up in the space of 2 weeks. But to put this into context we are still below the average 5 year price for gas delivered over a front winter season. Demand looks robust into next week and we expect that to give a strong price signal that may attract more LNG cargoes to the UK.”

Jamie Banks,

PPA Manager at New Stream

Low Wind Also Supporting Pricing

- Low levels of generation from wind turbines are also supporting electricity prices.

- Weather models show that there is potential for wind speeds to drop further next week.

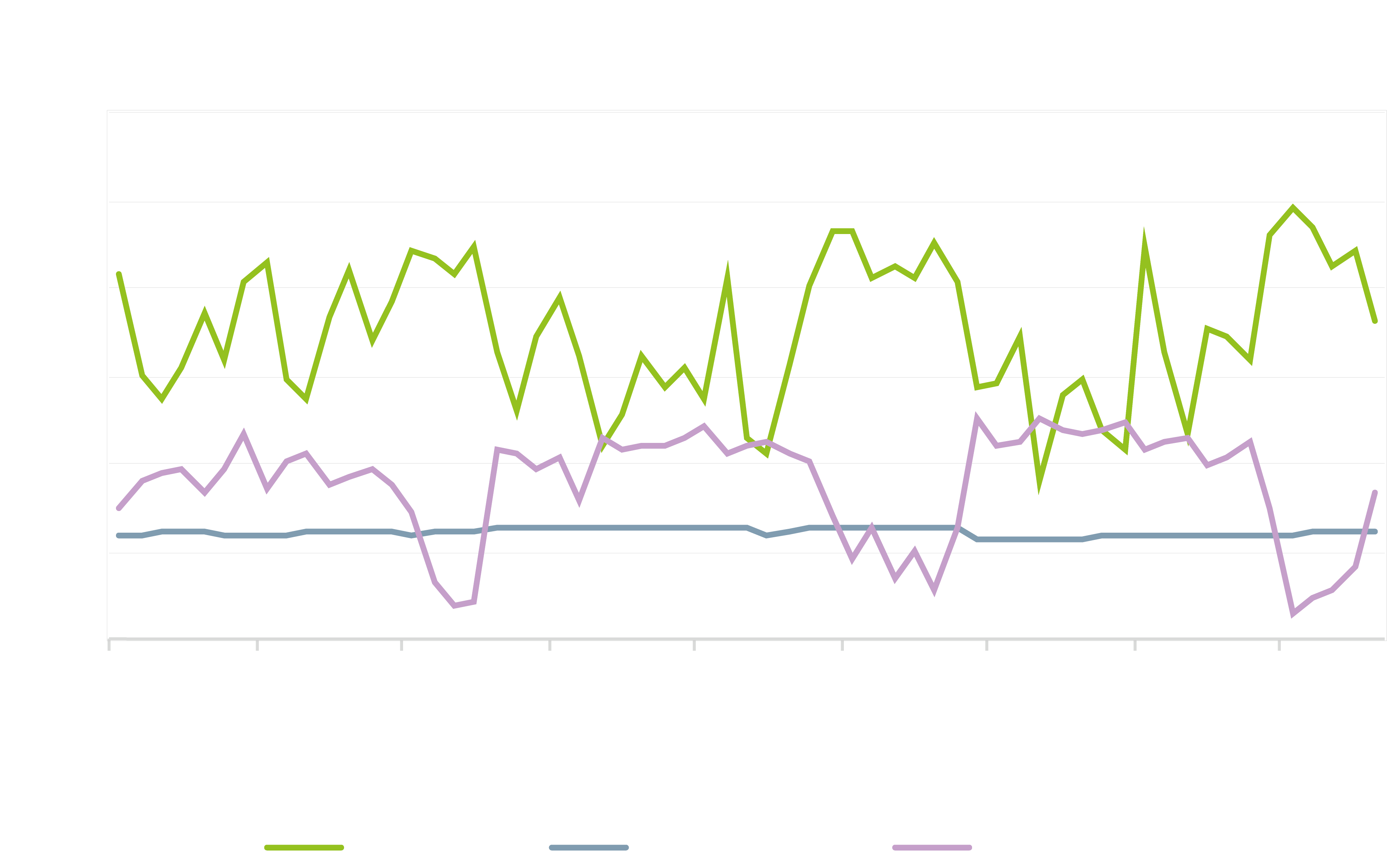

Daily peak generation by fuel type of the UK’s three largest contributing sources: CCGT, Nuclear and Wind

PPA Pricing

UK gas pushing power higher.

• Domestic heating demand and colder weather increasing demand.

• The market is also supported by positive vaccine news and moves in broader commodity and equity markets.

• Lower wind speeds continue to support spot gas and power markets.

• Demand forecast remain robust in the face of renewed pan European lock-downs.

• French nuclear generation issues that could have implication across European energy markets including the UK.

• Market priced risk premium for potential shocks as we enter winter.

|

“More positive news for renewable generators in terms of pricing this week. The cold weather and demand side picture is the key driver.

We are keeping our PPA and GPA clients with upcoming renewals updated in order to try and time best fixing. The market continues to be volatile but there appears to be some underlying strength.” Jamie Banks, PPA Manager at New Stream Renewables |

New Stream Summary PPA Recommendation

New Stream are flagging market strength to both renewable power generators and green gas exporters as a short-term fixing opportunity.

For those clients with either PPA fixes or upcoming renewals, market timing is key. Pricing one day versus another can be £2 – £4MWh.

New Stream are monitoring the market closely, running our analysis and making recommendations to clients.

As always, every client has slightly different requirements, so we work with them on a bespoke basis to find the best PPA solution.

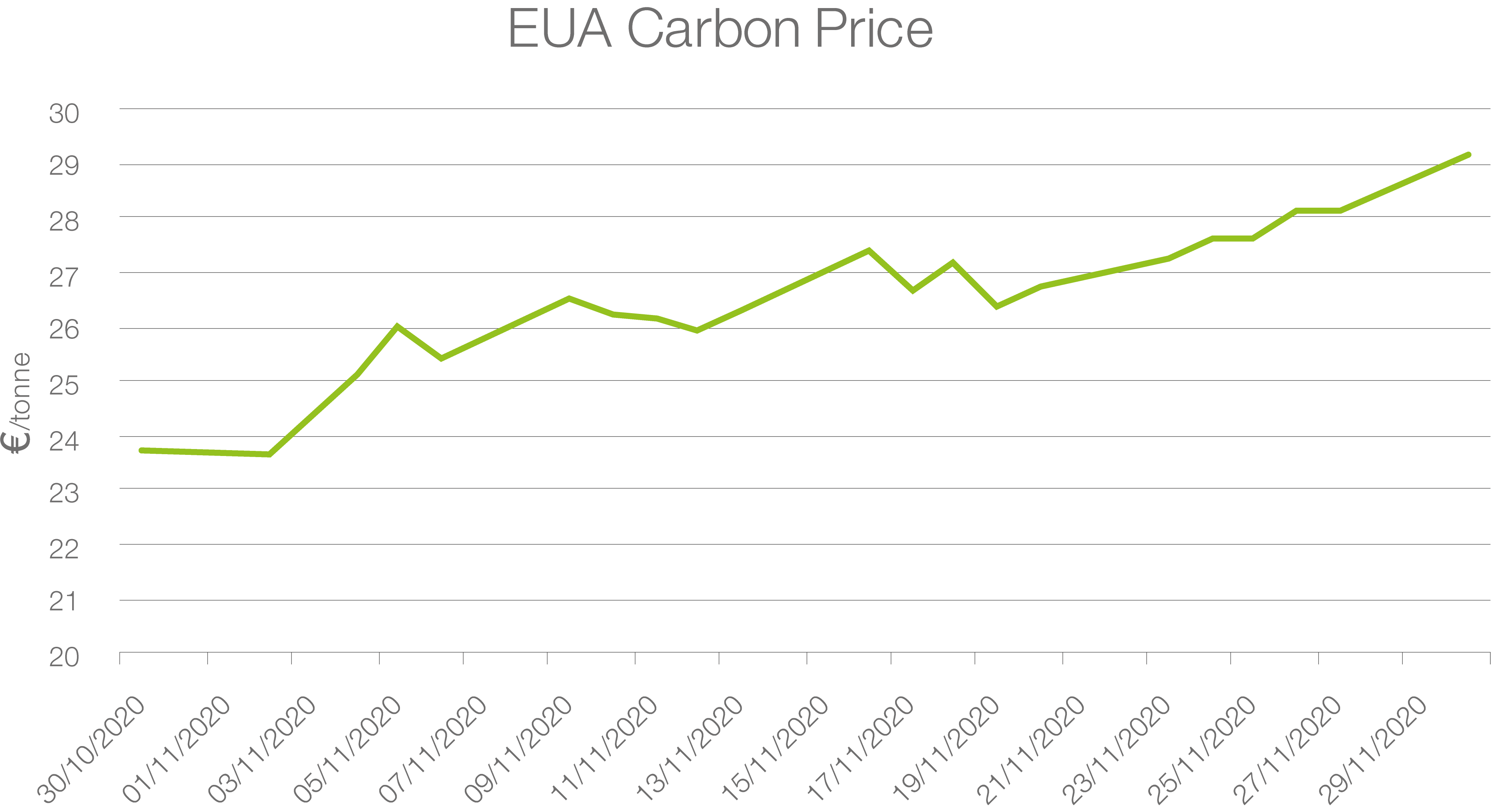

Carbon Market Update

‘It will be interesting to see how the next few months play out, but if suppliers cannot use EU GOOs for FIT levelisation then we may see sharp upward pressure on pricing.”

To discuss option on Green Certificate trading for both power and gas please contact Charlie Ward

E: charles.ward@newstreamrenewables.com

Green Certificate Market Commentary

REGO

Sellers appear reluctant to trade further out than spot due to uncertainty over pricing.

ROCs

CP19 Forecast values with buyout and recycle £52.40

Green Gas Certs / RGGO

Increasing differential between crop with and without carbon capture. Both EU and UK buyers increasingly specific on feedstock and methane slippage.

In Other News :

SSE and Equinor will develop with the world’s biggest offshore wind park in the North Sea after reaching financial close on the joint venture.

The project called Dogger Bank will produce enough renewable electricity to supply 5% of the U.K.’s demand.

- The equivalent of six million homes.

- Total investment in the first two phases of the project will be around £6 billion.

- Each phase has a capacity of 1,200MW and will generate around 6,000 gigawatt-hours.

Intergen gets go-ahead for giant battery storage project in Essex

- The government granted consent for the £200 million development.

- Maximum output of 320MWs.

- Expected to be the biggest in Europe.

- Intergen is 50% owned by Seven, a Czech company with the other 50% owned by China Huaneng and Guangdong Yudean.

Boris Johnson is facing a fresh test of his green commitments as the UK prepares to submit its national plan on future carbon emissions

• UK will host the postponed Cop26 summit next year.

• Pressure is growing to come up with an ambitious national target – known as a nationally determined contribution (NDC).

• The UK could aim for a cut of 70% in emissions by 2030, compared with 1990 levels.

Energy prices are rising on the expectation

Energy prices are rising on the expectation