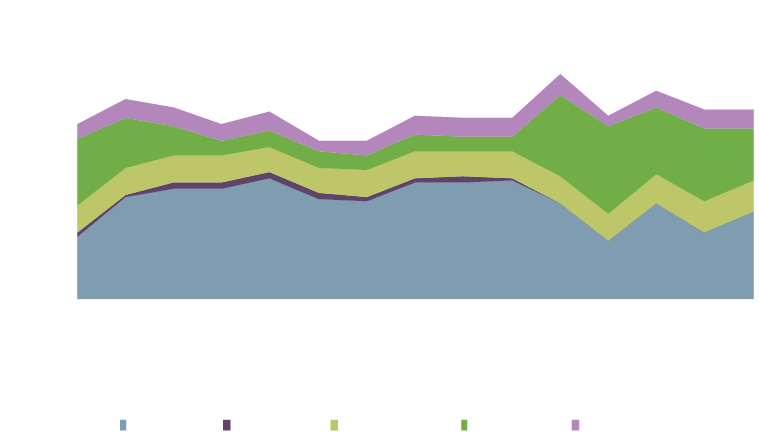

On the 19th of May we saw the start of carbon pricing under the UK ETS following the 1st UK Allowance (UKA) Auction on ICE.

Activity and liquidity was limited but secondary market depth is expected to develop on the ICE platform over the coming weeks.

- The auction of just over 6m UKAs cleared at £43.99 per UKA.

- The benchmark December future contract last traded at 49.50 pounds per ton (57.42 euros) on ICE.

At the same time the European EUAs were on a downward trajectory widening the spread between the two ETS schemes.

- New Stream saw an equivalent premium of circa 12%.

- Volumes were sold but there were only 14 successful bidders.

- A cap of 155,671,581 allowances has been set for 2021.

The UK ETS Authority will consider market stability mechanisms to manage future prices. If the average allowance price on the secondary futures market is double the average price for the preceding 2-year period for 3 consecutive months, a Cost Containment Mechanism (CCM) will be triggered.

Commentary

Tom Rees

Market Analyst at New Strea

How the ETS works:Under the UK ETS, power plants and other high emitting corporates will be charged for every tonne of CO2e they emit beyond a certain limit. They will also be able to sell excess reductions for profit to other companies that have failed to remain below their specific limits. ETS schemes like this and carbon pricing mechanisms are only set to become more popular and in the coming months. Clearly ESG (environmental, social and governance) is a huge topic right now and we are going to see as more and more nations focus on climate targets. |

Question ?A key question that remains to be answered:will the UK and EU develop and deliver a link between their two ETS which will enable bi-directional trading ? Industry bodies such asEnergy UK, signed a letter on 14th April to the government and EU asking for this linkage to be considered. Benefits in this letter included stronger liquidity, ability to attract abatement from across Europe and avoidance of price competition. |

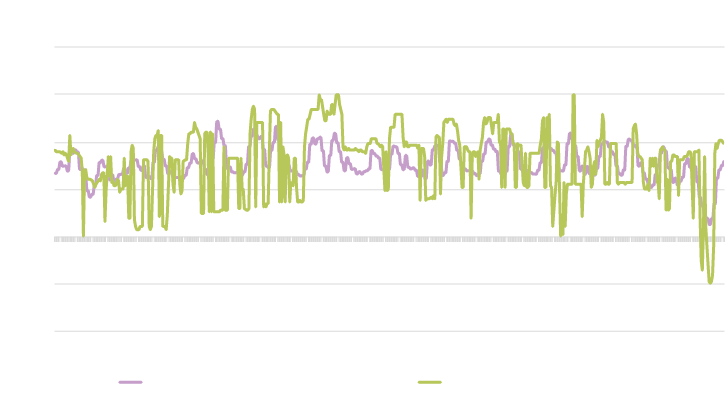

UK Power and Gas Contracts Sold Off but Rally Again

UK power and gas contracts sold off after a strong and sharp rally in prices.Prices bounced back this week as gas storage, supply issues and a more positive macro outlook come back into focus. NBP gas was initially sold off on the back of profit taking and news that the US administration will waive sanctions on the Nord Stream 2 pipeline (see separate update). Even if Nord Stream does flow in 2022 there are still significant short term gas issues to resolve:

Europe will need to stock up some 65-70 billion cubic meters of natural gas this summer. |

Commentary

We have seen bullish European gas market fundamentals for 12 months or so now and gas is still key for UK power pricing and the PPA market. It’s been a volatile week or so that has certainly kept us on our toes. The fundamental picture is still tight and demand for storage injections over the summer should keep pricing relatively strong. Obviously we have seen some price volatility across carbon markets and more generally in terms of global equities that have created some uncertainty but prices have come back again this week. |

Biden waives US sanctions on Nord Stream 2 Russian Gas Pipeline

Biden administration has waived sanctions on a company building a controversial gas pipeline between Russia and Germany.

At the rate it is being constructed, Nord Stream 2 is expected to be completed by the end of the year.

Nord Stream provides Gazprom with direct access to European consumers.

At a length of 1,230 kilometres, it is to follow the route of the existing Nord Stream twin pipeline underneath the Baltic Sea.

Charles Ward,

Head of Renewables at New Stream

“Back in 2018, the U.S. and Poland opposed the Nord Stream 2 pipeline. They said that they saw it as undermining Europe’s overall energy security and stability.”

UK Power Purchase Agreements:

| Whilst we fully acknowledge the continued bullish backdrop to the UK energy complex, and are certainly not trying to call the top of the market, New Stream would expect to see the pace of gains challenged in the near term.

New Stream PPA desk have been successfully locking in attractive PPA rates for renewals through 2022 and into 2023 on a relative value basis. We have continued to benchmark forward prices and asses value against the FiT export tariff rate. We will continue to flag fixing opportunities to our clients with renewals and forward expiries. |

PPA View and Strategy Recommendation

Charles Ward,

|

UK System Overview:

We have seen wind generation pick up in the last few weeks in addition to strong CCGT presence.

UK Energy System Data and spot market volatility:

The increasing carbon and gas pricing has pushed wholesale power prices to record highs.

We have seen Day-Ahead contracts up almost 50 £/MWh from last year’s position.

This has also been reflected in above seasonal average imbalance pricing.

In Other News:

Carbon EUA Pricing Back at all Time Highs U.K. Power Grids Get £300 Million for Upgrades to Meet Net Zero.

The government via the energy regulator OFGEM aim to triple the number ultra-rapid electric car charge points in the UK to tackle the issue of “range anxiety”.

200 low-carbon projects to be commissioned across the country over the next two years.

- 1,800 new ultra-rapid car charge points.

- A further 1,750 charge points in towns and cities.

“Drivers need to be confident that they can charge their car quickly when they need to,” said Jonathan Brearley, CEO of Ofgem.

Sizewell B Nuclear Plant Forced to Stay Shut over Safety Concerns

The reopening of Sizewell B has been delayed by three months, with repairs needed to steel components in the nuclear power station.

EDF took the Suffolk power station offline on 16 April for planned maintenance and had been due to return it to service at the end of May.

This date has now been extended until the end of August.

According to The Times, repairs are needed to some of Sizewell’s stainless steel “thermal sleeves”, which form part of the mechanisms that insert control rods into the reactor core to shut it down.

Extreme wear could lead to parts of the thermal sleeves loosening and obstructing the control rods.

EDF is currently assessing the cause and extent of maintenance required. The company said it believed a “very small proportion” of the 53 thermal sleeves needed replacing and was confident.

Jamie Banks

Jamie Banks