|

European leaders are increasingly concerned about the Russian military build-up on Ukraine’s borders. |

On Tuesday, Joe Biden used a video call with Russian President Vladimir Putin to warn Moscow against |

It appears that the U.S. will try to use economic penalties as leverage. |

|

Traders are keen to understand if these penalties and sanctions |

TTF gas at the Dutch hub traded as high as 95 euros MWh. |

|

“With storage where it is right now and increased tensions on the Russian border, it’s hard to see spot gas coming down significantly in the short term. But it is going to be a complete rollercoaster, and not one everyone wants to be on!”

|

“Further out on the curve, pricing has been more stable, and we have seen clients taking advantage of that stability and relative market strength to fix PPAs and GPAs. Again the overall rationale has been risk-off, sell into strength, protect the downside.” |

LNG Supply Issues

- Liquefaction problems in Australia forced Shell to cancel several liquefied natural gas shipments.

- These supply issues are likely to intensify global competition for spot LNG cargoes.

- Shell shut production at its Prelude LNG facility on Friday.

- Chevron also shut one of three processing units at its Gorgon LNG plant.

- There is currently no time frame for restoring output at the 4.5 million tonnes a year facility.

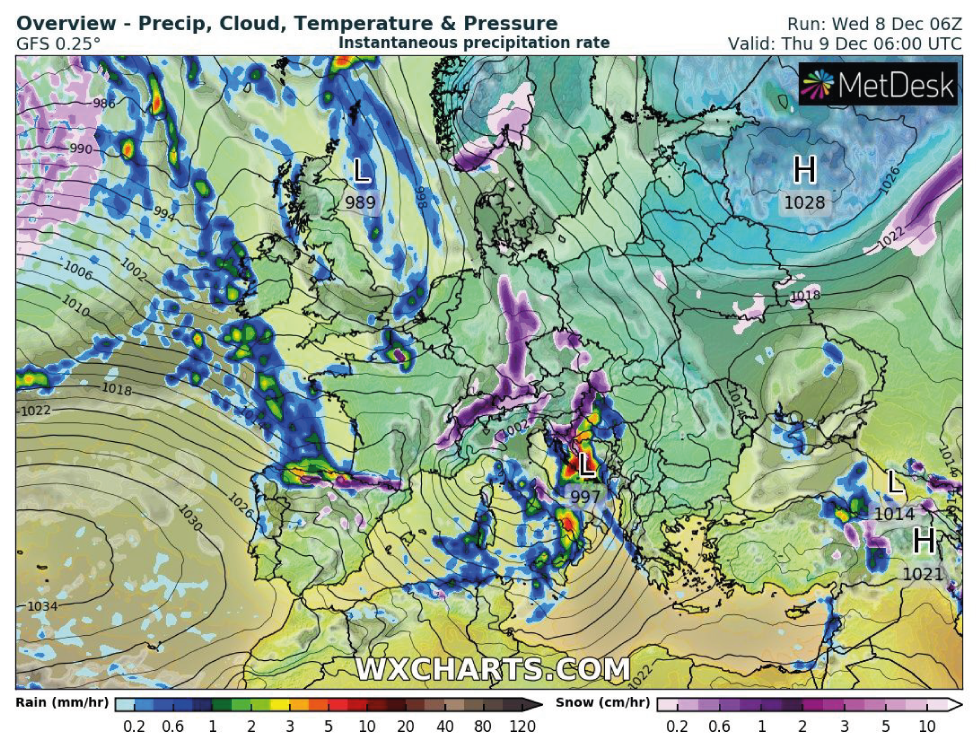

Cold Weather Supporting European Power Prices

- Energy Markets Remain Volatile on growing cold weather forecasts.

- Below-average temperatures across Europe saw daily power prices rise above 250 euros at the start of the week.

- Temperatures in the north of Sweden are dropping below -40 Celsius.

- Nordic spot power climbed to the second-highest level on record 226.50 euros.

- In Poland, prices spiked up close to 70% at 240 euros.

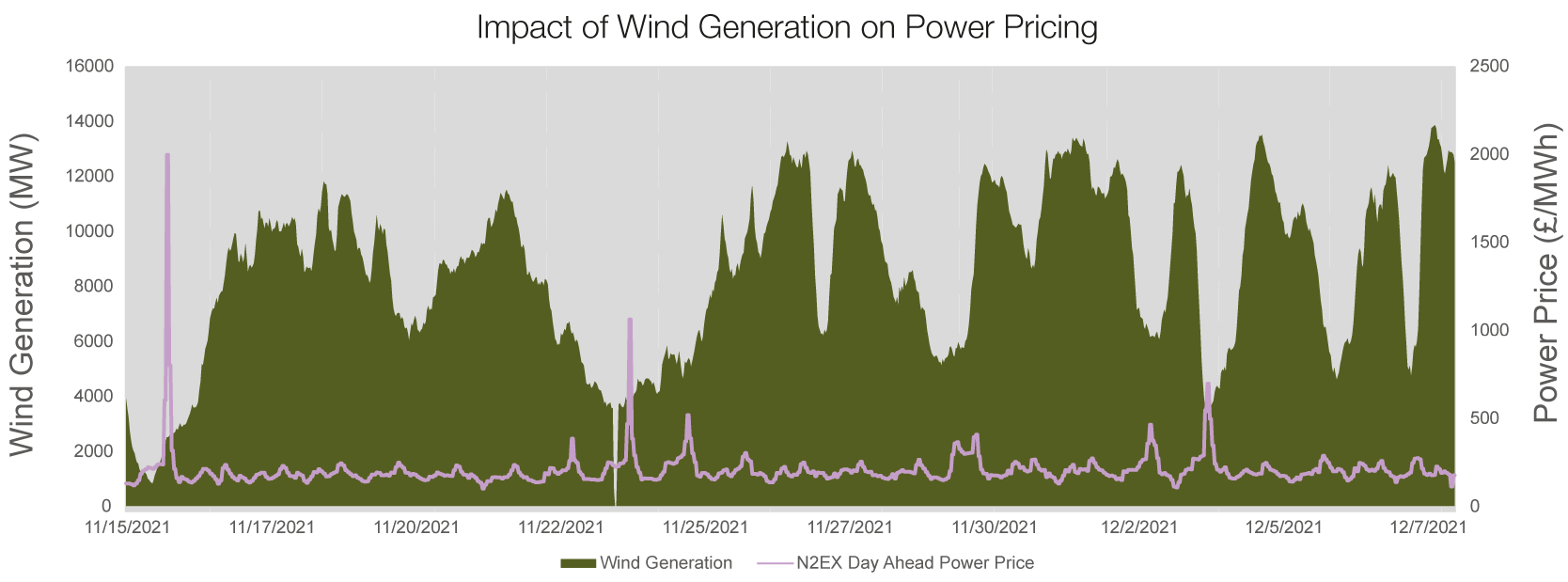

Wind Generation

|

|

New Stream PPA view for Renewable Generators

- We are seeing a risk-off PPA fixing strategy from investors and asset owners.

- Fundamentals remain tight, but price volatility is high.

- New Stream continues to hold a “neutral” view in the short term.

- We expect volatility to increase and the rate of gains to slow.

- For those generators looking for price certainty and downside protection, we have been fixing PPAs and GPAs out into 2023 and 2024.

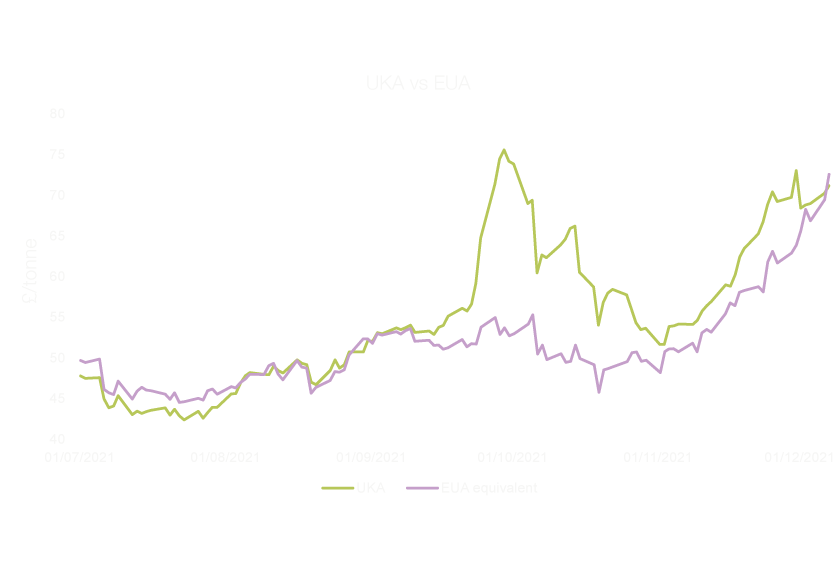

Carbon Markets

- The UK ETS CCM (Cost Containment Mechanism) has been triggered for December.

- By no later than the 14th December, the ETS authority will consider what intervention to make to address the sustained price movements.

- UKA’s are currently trading around £72/tonne, with EUA’s upwards of €87/tonne.

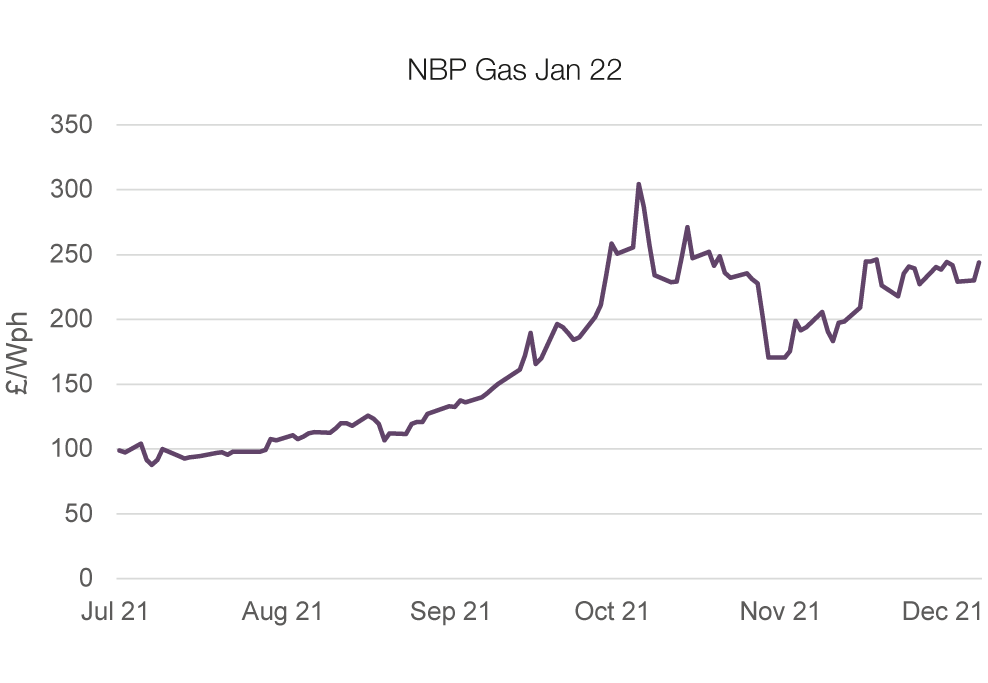

Power Purchase Agreements (PPAs) Fundamentals

- Gas and Carbon are still critical drivers of U.K. power and PPA pricing.

- Day-ahead, NBP gas is trading around 235p per therm.

- Lower LNG supply and reduced Russian flows supported spot and front-month pricing.

- Price volatility continues particularly at the “front end of the curve”.

Key Drivers:

- European gas and geopolitics.

- Broader commodity complex remains bullish.

- Reduced pipeline gas from Russia and Norway.

- Strong Asian LNG buying interest and Australian supply issues.

- Continued Coal market tightness.

In other news

The Dogger Bank Offshore Wind Farm Phase 3 Gets A Funding Green Light

SSE Renewables and Equinor have secured £3 billion of finance to construct the third phase of the Dogger Bank C offshore wind farm that will create the world’s largest offshore wind farm when completed in March 2026.

SSE’s investment forms part of its recent Net Zero Acceleration Plan, which included fully funded £12.5bn strategic capital investment plans to 2026 alongside ambitious 2031 targets, aligned with net-zero and 1.5 degrees.

Dogger Bank C has a capacity of 1,200MW and will generate around 6,000 GWh a year, producing enough clean, renewable electricity to power six million U.K. homes. SSE is leading construction across all three phases, and Equinor will operate the wind farm after that.

£863 Million Hydrogen Project in Northeast England

An ambitious £863M plan to change the Northeast of England’s natural gas network to distribute hydrogen was outlined in a feasibility report delivered by the East Coast Hydrogen Consortium. The consortium comprises Northern Gas Networks, Cadent Gas, and National Grid.

The plan identifies that hydrogen could supply over 4 million households and as many as 39,000 industrial and commercial gas users for approximately £13 per household per year. East Coast Hydrogen also claims it can connect 7GW of hydrogen production by 2030 – way above the U.K. Government’s 5GW target.

East Coast Hydrogen believe the project would be the initial step in the national gas grid conversion to hydrogen and be the blueprint for the U.K. while creating tens of thousands of jobs in this exciting future hydrogen economy.