LNG Supplies Remain Tight as Storm Ida Weakens

Commentary Jamie Banks,

PPA Manager at New Stream Renewables

|

U.S. gas futures contracts soared to multi-year highs on Friday. |

The latest weather reports show that Hurricane Ida appeared to be moving away from the main liquefied natural gas (LNG) export facilities. | The next move now depends on damage assessment to any LNG facilities. |

LNG export demand has been one of the factors supporting natural gas prices in North America this summer. |

Source: cleanenergywire.org

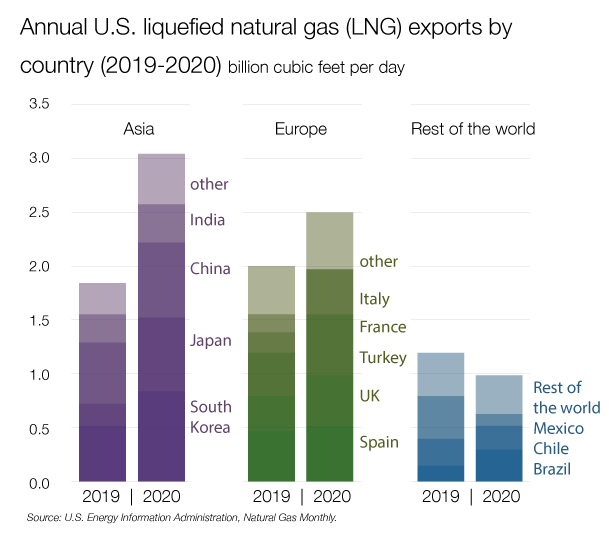

Why is this Important for U.K. Energy Prices?Europe has an extensive network of liquefied natural gas terminals that receive cargoes from around the world. In recent years the U.S. has supplied significant gas volumes to Europe as the shale boom kicked off. U.S. LNG exports to Europe averaged 2.5 Bcf/d, an increase of 0.6 Bcf/d compared with 2019. LNG exports to Europe accounted for 39% of total U.S. exports. |

|

LNG supplies in July and August fell to the lowest for that month in three years. With global demand still strong and the outlook for September doesn’t look great in terms of supply.

We have also seen LNG traders stored in Spain looking to cargoes to capture higher prices in Asia.

Over the last nine months, LNG prices have rocketed to record highs on the back of global production outages and shipping delays.

They have outpaced prices in much of Europe, creating an arbitrage opportunity for traders.

Gas market fundamentals remain tight.

We still need to refill gas storage, but with the current fight for cargoes, it seems like the market will be very tight. Pipeline flows need to increase significantly, but we just aren’t seeing that now. This situation is very bullish for U.K. energy prices and PPAs in general.”

Charlie Ward,

Charlie Ward,

Head of Renewables at New Stream

New Stream View for Renewable Generators:

Fundamentals remain tight, although we could see some “profit-taking” / correction over the coming trading sessions.

- We remain cautiously bullish in the short term but expect volatility to increase and the rate of gains to slow.

- For those generators looking for price certainty and downside protection, we have been fixing PPAs and GPAs out into 2022 and 2023.

Commodity Inflation

“As the global economy emerges from the pandemic, energy prices are rising around the world, fuelling concerns about inflation.”

Tom Rees, Energy Analyst at New Stream

|

|

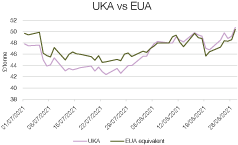

Carbon Markets

|

|

|

|

Power Purchase Agreements (PPAs) Fundamentals

Power Purchase Agreements (PPAs) Fundamentals

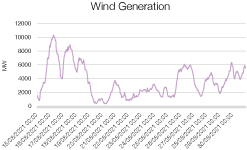

- Gas and Carbon are still critical drivers of U.K. power and PPA pricing.

- Day-ahead NBP gas is trading around 115p per therm.

- LNG regasification is nominated at 8 MCM. Gas for power demand is forecast at 50 MCM.

- Gas demand is similar to weekly averages at around 150 MCM.

- Bullish oil market sentiment and gains in the broader commodity complex support power and gas curve contracts.

REGO

In the secondary market, bio / green REGOs is around £1.35-£1.50. Deep Green certificates (wind / solar/hydro) trading in the £2-2.30 region.

We see continued interest from U.K. and overseas markets, with Netherlands and Scandinavia being the most active.

ROCs

CP19 2020/21 trading at £54.25-54.55 and CP20s at £60.

For CP20, we forecast the recycle value to be in the region of £10.25/ROC.

The effect of Covid lock-downs reducing demand, winter output from onshore and offshore wind, and new capacity retrospectively accredited creates uncertainly around CP19 pricing.

In Other News

The U.K. government has agreed on funding and preferred type of small nuclear reactor for a 170 million-pound ($236 million) demonstration program.

The government has an objective to build around a dozen new plants, but soaring costs will impact these plans.

The U.K. government will have to move a lot faster than planning to build a demonstration prototype by the mid-2030s. The U.K. generates about 20% of its electricity from nuclear. Half of the UK’current capacity is to be retired well before the end of this decade, and one reactor was already prematurely shut down for good.

Issues aside, U.K. government ministers said they consider high-temperature gas-cooled reactors (HTGR) as the “most promising model” for the pilot program. HTGR reactors can produce electricity, hydrogen and process heat.

Maersk Accelerates Fleet Decarbonisation with New Vessel OrderThe Danish company Maersk has ordered eight vessels to run on carbon-neutral methanol to accelerate the decarbonisation of its fleet and meet the demand for greener transportation. The Danish company has committed to ordering new vessels that run on carbon-neutral fuel as it seeks to deliver net-zero emissions by 2050. With a typical lifetime of 20-35 years for ships of this class, it means Maersk must have a carbon-neutral fleet by 2030. Up to sixteen thousand containers will be carried by each ship and be delivered to Maersk by early 2024. The vessels will be 10-15% more expensive than normal ones and will cost $175 million per ship, according to Maersk’s Ole Graa Jakobsen.

|

Inflation in France Hits Highest Level in Almost Three YearsInflation in France climbed to its highest level since late 2018 as food and energy costs accelerated, and the end of the sales season saw manufactured goods prices rebound. France is the euro area’s second-largest economy, and August’s 2.4% year-on-year increase in consumer prices is above the European Central Bank’s 2% target. Also, it beats the median 2.1% estimate predicted by economists. French data also showed that consumer spending fell 2.2% in July from June, an unexpected drop as households cut back on manufactured goods purchases. A sharp decline in car sales contributed to the weak reading. |