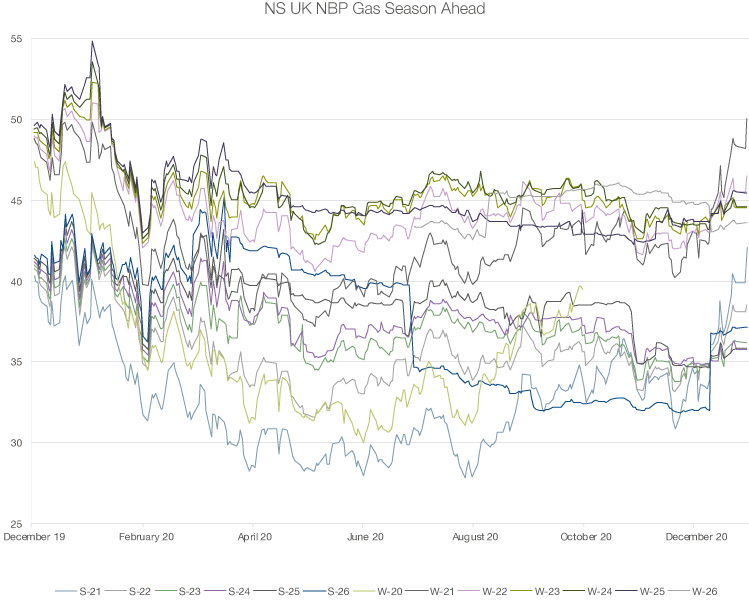

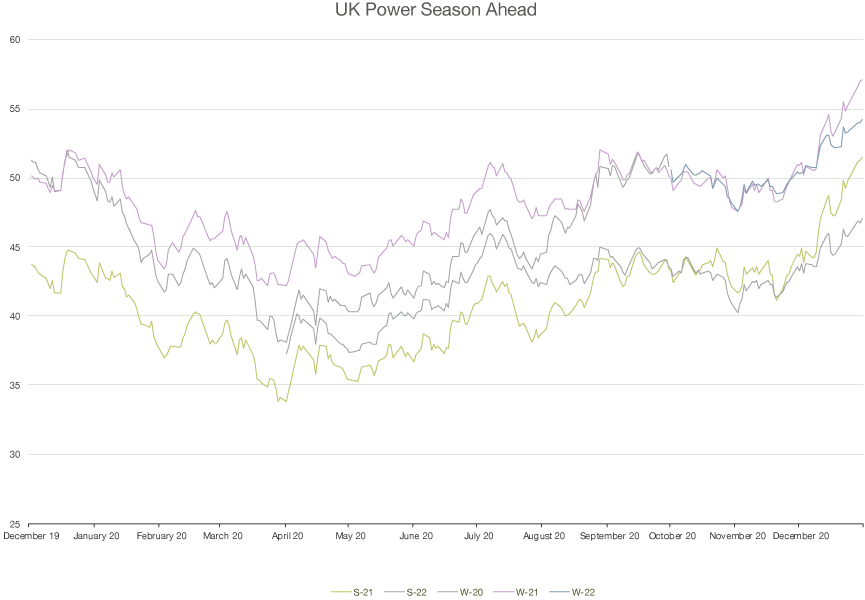

Cold weather and relatively low wind speeds are supporting prompt gas and power contracts.

Strong gas demand for heating is also moving short term power contracts higher.

“Even though market liquidity has been low between Christmas and New Year we have been locking in some forward NBP gas hedges for our green gas clients. We still see some upside price potential but have been recommending layering in some volumes which is working well. Part of our role is flag market strength like this as a selling opportunity.”

Charlie Ward,

Head of Renewables

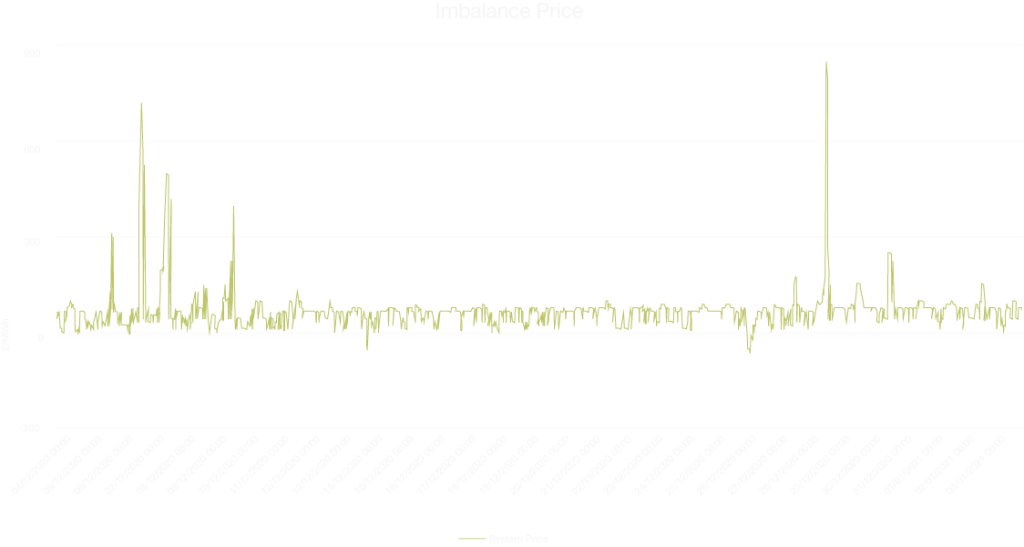

Spot market power and cash-out pricing was extremely volatile over the holiday period.

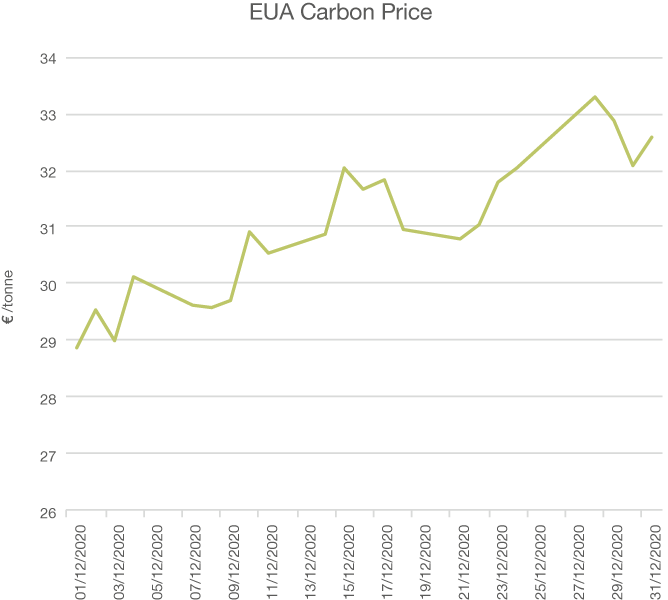

Carbon EUAs remain very well bid above the €32 mark.

Positive vaccine and broader financial market news have also been positive for pricing.

“We have seen very low market liquidity over the holiday period and price volatility has again been in evidence across short term power and gas contracts. Lots of focus has been on short term weather forecasts that have been bullish for gas and in turn UK power. PPA pricing is continuing to consolidate and move to the upside with Carbon EUAs up around the €32 mark and coal providing support to European energy markets. Although in the short term we don’t see significant risk of a downward price move we do see this as a potential selling and fixing opportunity for our clients.”

Jamie Banks

PPA Manager at New Stream

New Stream Client Dashboard

You can view more market data and live PPA and GPA pricing via our online client dashboard.

www.newstreamrenewables.com

If you would like to request access to this tool please email francesca.reay@newstreamrenewables.com