UK Power Pricing Supported by Vaccine News

- After some price weakness in UK gas and power pricing last week the market found some support on vaccine news and moves in broader commodity and equity markets.

- News of a vaccine from Pfizer, which prevents 90% of new COVID-19 infections provided bullish sentiment and gains on strong momentum that may continue.

- Brent crude was up 5% at $39.45/bbl as oil was buoyed by stronger macro sentiment.

“There are some reasons to be positive which is great. The market is still trying to digest the vaccine news but there is certainly some buying support for both gas and power contracts.We are keeping our PPA and GPA clients with upcoming renewals updated in order to try and time best fixing. Not easy with current market volatility but we have still managed to achieve some good levels for clients on power and green gas.”

Jamie Banks

PPA Manager – New Stream Renewables

In macro economics….

- Over the weekend Joe Biden was widely held up as the victor of last week’s US election, however the Trump campaign vowed to take legal action over the result.

- US non-farm payroll data released Friday showed that the US added 640,000 new jobs to the US economy in October.

- Unemployment rate fell to 6.9% far better than analyst’s expectations for an unemployment rate of 7.7%.

- Major equity indices have seen a strong rally with the S&P 500 ending the week up 7.5%.

- The volatility measure or VIX sometimes referred to as the ‘fear gauge’ fell 35% week on week.

What This Means for PPA Pricing ?

New Stream Summary PPA Recommendation :

- The underlying power market is still showing fundamental reasons to be positive about potential further increases, so we are working with PPA clients to ensure we have flexibility to re-contract on a forward looking basis if the market continues to rise.

- For those clients with either PPA fixes or upcoming renewals market timing is key. Pricing one day versus another can be £2 – £3MWh. New Stream are monitoring the market closely, running our analysis and making recommendations to clients.

- As always every client has slightly different requirements so we work with them on a bespoke basis to find the best PPA solution.

“Lower wind speeds continue to support spot gas and power markets and demand forecast remain robust in the face of renewed pan European lockdowns.

There has been some pull back on the buy side of the LNG market that may take the heat out of some of the pricing but we see this as relatively short term.

We still hold the view that there are fundamental reasons why there should be a market priced risk premium for potential shocks as we enter winter.

There is clearly issues in France with their nuclear generation that could have implication across European energy markets including the UK.

If we get some cold in addition to this then that could reverse interconnector flows as we saw in Winter 2016.” Banks said

New Stream FIT Export PPA for Baseload Generation

|

|

Monthly payment in arrears of export volumes priced against System Sell Price Monthly payment in arrears of export volumes priced against System Sell Price |

Quarterly reconciliation of monthly export payments against Export Tariff Quarterly reconciliation of monthly export payments against Export Tariff |

|

|

|

|

Please contact Charlie Ward for more information on this option

Please contact Charlie Ward for more information on this option

Carbon Market Update

- EU EUA Carbon has rallied over 5% to a one month high near EUR 27.

- Carbon prices rallied as they tracked a sharp move up in wider financial markets as positive news surrounding an effective COVID-19 vaccine was reported.

- EUAs have caught also caught a bit of a tailwind after the election of Joe Biden, who seems set to prioritise climate change policy in his new administration.

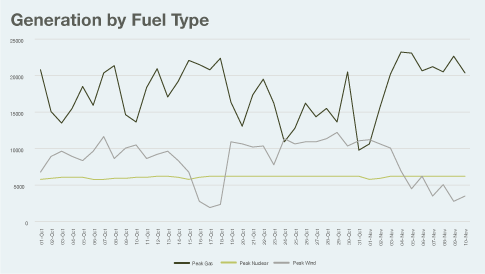

Margin alert from National Grid on low wind as Britain fears black-out risk

Wind Generation Uncertainty :

- There are more than 10,000 wind turbines located in Britain.

- Theoretical maximum output of 24 gigawatts.

- Over a typical year, their output averages about third of that level.

- This is equivalent to the annual energy needs of 18 million homes.

- National Grid issued a system warning on Wednesday 4th November.

- This expected margin shortfall was at one stage around 800MW.

- New Stream predicted a number of scenarios where power prices could exceed £150 MWh.

- *Wind generation was down from 10000MW to circa 4000 MW at peak times.

- New Stream continue to see robust peak demand during winter Covid restrictions ( peak demand expected to remain in excess of 40,000 MW despite lockdown restrictions ).

“We have again seen low wind output coinciding with a number of generator outages resulting in lower margins as the cushion of spare capacity we operate the system in has been significantly reduced. We flagged tight margins at the start of the week and that has certainly played out both in terms of margin and pricing.”

Said Paul Sanders,

Head of Generation at New Stream

Green Certificate Trades and Latest Pricing

ROCs

ROC CP18 Recycle forecast at £5.80 with a mutualisation payment of £0.15 , total ROC value at £54.58.

ROC CP19 Recycle forecast at £2.24, continued to be driven down by demand destruction with a total value forecast to be £52.39.

ROC CP20 total forecast at £57.45.

Green Gas Certificates

Market now recovering strongly, with food waste certificates trading in the £8.40 – £8.75 range.

Crop based with carbon capture at £7.35-£7.50 and residue with carbon capture at £8.25 – £8.50.

Pure crop certificates at the £6.50 – £6.75 level.

REGO

CP19 wind has traded at the £0.20 and CP20 solar recently traded at £0.37.

New Stream November REGO Index assessment at £0.55.

In Other News

Ofgem:

ROCs presented and redistribution of buy-out fund 2019-20

The RO requires licensed electricity suppliers to source a proportion of the electricity they supply to UK customers from renewable sources.

The revised obligation levels for 2019/20, announced by BEIS on 28 September 2018 are:

- 0.484 ROCs per MWh of electricity supplied to customers in England, Wales and Scotland.

- 0.19 ROCs per MWh of electricity supplied to customers in Northern Ireland.

The ROC recycle value for CP18 has been announced. For the financial year 19/20, 89.1% of the ROC Obligation was met and £5.02 per ROC has been redistributed.

There is a shortfall of £105.555 million which will lead to a late payment distribution on January 1st 2021, which is when the final recycle value will be confirmed.

Improved cash-flows

Improved cash-flows 100% pass through of prevailing Export Tariff rate less monthly payments already made

100% pass through of prevailing Export Tariff rate less monthly payments already made Enhanced £/REGO paid after receipt of REGOs

Enhanced £/REGO paid after receipt of REGOs Monthly payment in arrears of FiT Generation

Monthly payment in arrears of FiT Generation